No, Student Loan Cancellation will not Benefit the “Wealthy”

Cancellation will largely benefit the un-wealthy. Also, the highest earning borrowers tend to be older people who have been harmed by the debt for decades.

A number of beltway “experts” are currently claiming that cancelling student loans would unduly benefit the wealthy. Adam Looney (The Brookings Institute), for example, claims that broad student loan cancellation would be regressive because student loan borrowers who are in the top 20% income bracket hold 30% of the debt. Looney uses the example of a young, high-earning medical school graduate who earns more than a young non-college graduate to claim that broadly cancelling loans would be unfair.

Very simple analysis of this claim, however, reveals that not only is Looney’s claim completely wrong- both by his own measure and when compared to other federal loan cancellation programs- Looney’s analysis is deeply flawed, and badly misleading to begin with.

First the obvious:

- Wealthy people cannot get federal student loans. 100% of all borrowers had to prove financial neediness in order to get the loans.

- 40% of all borrowers never graduated.

- Tens of millions of borrowers went to trade schools and community colleges.

- Before the pandemic, 85% of all borrowers were either unable to make payments, or were paying but couldn’t pay enough to avoid an increasing loan balance. Wealthy people don’t get behind on their debt.

- Today, 80% of all borrowers are unable to make payments. These, clearly, are not wealthy people.

The above really answers all the relevant questions, but Looney’s study was bad. By his own admission, the data he relied on, (voluntary survey data), was dicey at best. Adam’s own words: “The sample is too small, 30 percent of aggregate student debt is missing and not accounted for, the value of debt is frequently missing and statistically imputed”.

Given that financially distressed individuals (who tend to be lower-income) are far less likely than financially stable individuals (who tend to be higher-income) to fill out voluntary surveys, and the fact that 30% of the debt is unaccounted for in the first place, the accuracy of Looney’s top line claim that the highest 20% of earners own 30% of the debt is dubious, at best.

But even accepting this suspicious claim implies directly that the bottom 80% of earners hold 70% of the debt. So by Looney’s own analysis, cancelling federal student loans will largely benefit the “un-wealthy”, and thus cannot be called regressive.

This is brought into even sharper relief by considering another federal loan cancellation program, Paycheck Protection Program (PPP) loans. The top 20% of earners received 75% of all PPP loans, and thus will be the overwhelming beneficiaries of this loan cancellation, compared to the bottom 80% of earners, who hold only 25% of the debt.

Not to mention: Data from the National Bureau Economic Research shows that very little of the PPP loan funds actually went to pay workers. The large majority of these funds (66–77%) went to business owners and shareholders.

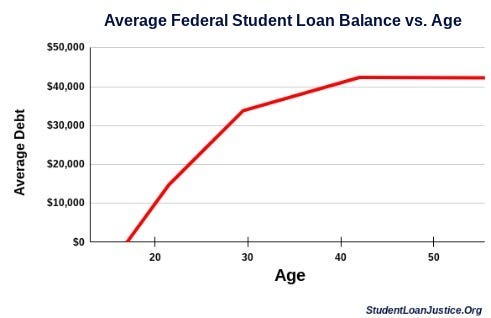

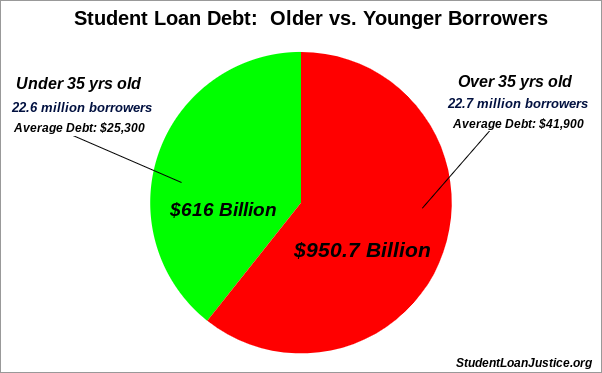

But what is far more important: Statistically, the highest balance, highest earning student loan borrowers aren’t young people at all- they are older borrowers who, by and large, have been stuck with student loans for years or decades, and who now owe far more than younger people, despite having borrowed far less, and many years or decades ago.

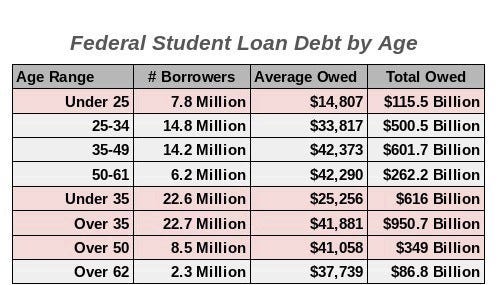

Interestingly, people over the age of 35 now (slightly) outnumber people under 35 with federal student loan debt (22.7 million people vs 22.6 million), but they owe about 50% more than their younger cohorts, both in total and as a percentage.

Considering an even wider age gap (people over 50 vs. people under 25) reveals that this disparity becomes much worse as people get older. Borrowers over the age of 50 now significantly outnumber those under the age of 25 (8.5 million people vs. 7.8 million), and they owe triple more debt than their younger cohorts in both total debt, and average loan balance.

Looking at the data in this more relevant and appropriate context illustrates just how broken the federal lending system has become.

The beltway’s “regressive” argument falls apart in this more accurate context. Their definition of “wealthy”- which has nothing to do with net worth- is ridiculously ill-fitting to the borrowers who are being hurt. “Wealthy” people don’t struggle to repay their student loans into their 40’s, 50’s, and beyond.

The fact that older people tend to earn more than younger people does not mean that they are “wealthy”, and don’t deserve loan cancellation. In fact the opposite is true. The fact that their loan balances have exploded to owing far more than younger borrowers- despite having borrowed far less many years or decades ago- only demonstrates how broken this lending system has become, and why broad student loan cancellation is not only needed, but inevitable.

Some might suggest that Parent Plus Loans- a relatively new form of federal student loans where parents can borrow to pay for their kid’s college- explain these data, but they are wrong. PPL’s only account for about 6% of all federal student loans ($100.6 Billion over 3.6 million borrowers), and subtracting these completely from the “over 35” data (the appropriate age group for these loans) actually increases the average student loan debt of the remaining borrowers in this age group (from $41,881 to $44,507). So Parent Plus Loan debt serves to decrease- not increase- the average indebtness of this age group.

Interestingly, the relatively few young, “high-earning” student loan borrowers tend to refinance their loans out of the federal program with private lenders. They will not benefit from federal student loan cancellation.

Adam Looney pointing to rare, young, high earning borrowers as representative of high earning, high balance student loan borrowers is misleading, intellectually dishonest, and frankly shameful. Looney and his like-minded colleagues in Washington D.C. ought to be held accountable for blatantly misleading the public and defending this predatory, nationally threatening loan program.

While older people have been exploited under these predatory loans en masse, it makes no sense to pit the one group against the other. Younger borrowers today will be older borrowers tomorrow, and they will look much, much worse than this if this lending system is not massively overhauled, if not abolished entirely.

The federal student loan system is catastrophically failed by all rational metrics. 40% of all borrowers never graduated. 80% were “underwater” on their loans even before the pandemic. Similarly (before the pandemic), most student loan borrowers (64.3%) were not making payments at all. The default rate for 2004 students- who borrowed less than a third of what is borrowed today- is a whopping 40%. The subprime home mortgage default rate, by comparison was only 20%.

The lending system is finished, and no amount of beltway spin can make this not true.

This failure is a direct result of the wholesale removal of consumer protections from these loan. Not only have bankruptcy protections and statutes of limitations been stripped uniquely from federal student loans, the loans have also been stripped of Truth-in-Lending laws, greatly restricted Fair Debt Collection laws, and even state usury laws are not applicable to federal student laws. This, and a draconian collection regime which serves to hyper-inflate loans with penalties, fees, etc, have pushed the lending system over the brink of legitimacy.

The Founders called for uniform bankruptcy laws. This right must be immediately returned to all student loans. Biden should order the Department of Education to stop opposing student loan borrowers in bankruptcy court, and Congress should immediately return bankruptcy to all student loans by passing both S.2598 and HR. 4907.

Biden also has the power to cancel all federally owned loans without needing congressional approval, appropriation and without adding anything to the national debt. The President should exercise his loan cancellation authority, and end this national threat of a lending program.

We can do better than this.

If you agree, please sign and share this petition.