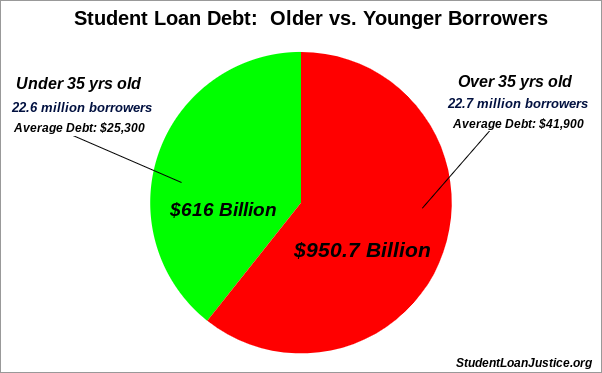

Older people outnumber younger people with student loans, and they owe far more.

A common popular belief about student loans is that they are a young person’s problem. It is generally assumed that most borrowers are able to have their loans repaid by their mid-30’s, or perhaps their early 40’s at the latest. People 50 or older who haven’t yet repaid their loans, conventional wisdom holds, are the outliers. This, however, is completely wrong.

This study relied only upon Department of Education Data for the fourth quarter of 2020. For the purposes of comparison, source data (rows 1, 2, 3, 4 and 8) were used to calculate the 5th, 6th, and 7th rows. The reader can readily verify the calculations.

Key Findings:

- There are more people over the age of 35 with student loans than under the age of 35 (22.7 million vs. 22.6 million), and they owe 154% more on average ($41,881 vs. $27,256).

- There are more people over the age of 50 with student loans (8.5 million) than people under the age of 25 with student loans (7.8 million), and they owe, on average, 277% more($41,058 compared to $14,807).

A key observation: People over the age of 50 typically went to college in the 60’s, 70’s, 80’s, and early 90’s. They borrowed very small amounts compared to today’s students. That they now carry triple the loan balances of recent graduates is clear evidence that their loans have increased dramatically from what was originally borrowed, often despite having made payments over the years- sometimes many multiples of whatever was originally borrowed. This is a direct result of both bankruptcy protections, and statutes of limitations having been stripped, uniquely, from the loans.

A 2014 GAO Study found that more than 50% of student loan borrowers 75 years of age or older were in default. For people between 65–74 years of age, this was 27%. We also know that about 20% of defaulted borrowers “rehabilitate” their loans into new, much larger, undefaulted loans (that, incidentally, have a 75% chance of defaulting again). Given this, it is likely that the majority of senior citizens with student debt are in default, or have defaulted on their loans. In addition to the vicious collection activities they have been subjected to over likely many years or decades, these people are likely having their social security and disability income garnished. Obviously, the vast majority of these seniors will never be able to pay off this debt.

Some might suggest that Parent Plus Loans- a relatively new form of federal student loans where parents can borrow to pay for their kid’s college- explain this fluke in the statistics. But these loans only account for about 6% of all federal student loans ($100.6 Billion over 3.6 million borrowers), and subtracting these completely from the “over 35” data (the appropriate age group for these loans) actually increases the average student loan debt of the remaining borrowers in this age group (from $41,881 to $44,507). So Parent Plus Loan debt serves to decrease- not increase- the average indebtness of this age group.

The data strongly suggests that older people are being exploited under these unconstitutional loans en masse, and they are being hurt far worse than younger borrowers. In the absence of the consumer protections mentioned above, and also Truth-In-Lending and Fair Debt Collection Laws, these loans have become viciously predatory and hyper-inflationary.

This is not what the architects of the Higher Education Act in 1965 had in mind when they launched this lending system. President Johnson, in fact, originally declared that the loans would be “free of interest”, but today, $100 Billion in interest alone is added to the citizen’s student loan debt.

The lending system is both nationally threatening- and by every rational metric- catastrophically failed at this point. Too many lives have been crushed, and too many are now under imminent threat. This lending system simply cannot be allowed to continue.

It is time to cancel all federally owned student loans, return banruptcy protections to all student loans, end this nationally threatening lending system, and replace it with a more fair, rational, dignified, and less expensive and socially damaging way to fund higher education in this country.

President Biden is obligated to issue an executive order returning bankruptcy protections to the loans. He should cancel all federal student loans, suspend the lending system indefinitely, and use the time afforded by this pandemic to replace it.

Congress must pass S.2598 and HR. 4907, bills that will return bankruptcy protections to both federal and private student loans.

If you agree, please sign and share this petition.

A Few Examples of Seniors with Student Debt: