Older People with Student Loans now Outnumber Younger People by a Wide Margin.

The Gap Widens, Despite Recent Cancellations for Older Borrowers

Awidespread misconception about student loans debt is that it is a young person’s problem. It is generally assumed that most borrowers are able to pay their loan balances down in their young working lives, and typically have finished repaying their loans by their mid-30’s, or perhaps their early 40’s at the latest. People 50 or older who haven’t been able to extinguish their loans are rare, and outliers, conventional wisdom holds. This is completely wrong. In fact, the opposite is true for the vast majority of student loan borrowers.

In 2021, we reported that the number of older people (over the age of 35) with student loans had surpassed the number of younger borrowers (under the age of 35), and that older borrowers owed, on average, far more than younger borrowers, despite having typically borrowed far less.

Today, that gap has widened significantly.

Key Findings:

- There are now 2.1 million more people over the age of 35 (23.7 million) with student loans than under the age of 35 (21.6 million), and they owe 160% more on average ($43,680 vs. $27,250).

- The disparity between people over 50 years of age and those under 25 years is even greater, with 9.1 million people over the age of 50 holding the loans vs only 6.8 million people under the age of 25. And on average, the over-50-year-old’s owe a whopping 302% more ($44,000 compared to $14,560).

Interestingly, the gap between older and younger borrowers has increased despite the President’s much-touted loan cancellations (which went largely to people over the age of 35).

Some might suggest that Parent Plus Loans- a relatively new form of federal student loans where parents can borrow to pay for their kid’s college- explain this growth of older borrowers and indebtedness vs. younger borrowers. These loans, however, account for only about 6.7% of all federal student debt ($109.8 Billion over 3.6 million borrowers), comprise only 10% of the debt for the over-35 age group, and these borrowers carry smaller loan balances ($30,500) than the group average, so these borrowers serve to decrease- not increase- the average indebtedness of this age group.

Akey observation: People over the age of 50 typically went to college in the 60’s, 70’s, 80’s, and early 90’s. They borrowed very small amounts compared to today’s students. That they now carry more than triple the loan balances of recent graduates is clear evidence that their loans have increased dramatically from what was originally borrowed, often despite having made payments over the years- even many multiples of what was originally borrowed in many cases. This is a direct result of both bankruptcy protections (called for prominently in the U.S. Constitution), and statutes of limitations having been stripped, uniquely, from the loans.

These data show strongly that borrowers are being exploited under these unconstitutional loans en masse. In the absence of the consumer protections mentioned above, and also Truth-In-Lending and Fair Debt Collection Laws, these loans have become viciously predatory, hyper-inflationary, and immortal for the large majority of borrowers.

This is not what the architects of the Higher Education Act in 1965 had in mind when they launched this lending system. President Johnson, in fact, originally declared that the loans would be “free of interest”, but today, $100 Billion in interest alone is added to the citizen’s student loan debt.

The lending system is both nationally threatening- and by every rational metric- catastrophically failed at this point. Student debt in over a third of U.S. States now exceeds those states’ budget. Recent repayment data also shows that since the pandemic repayment pause ended last year, fully 80% of all borrowers can no longer make payments.

It is now overwhelmingly obvious that the debt will largely not be repaid going forward. If this predatory lending regime is inflicting this much harm upon the current generation of older Americans, one can only imagine the harm it is poised to inflict on future generations. In short, this loan scam- and there really is not a better word for it- is no longer viable. It cannot and must not be allowed to continue.

It is time to cancel all federally owned student loans, return bankruptcy protections to all student loans, end this nationally threatening lending system, and replace it with a more fair, rational, dignified, and less expensive and socially damaging way to fund higher education in this country. But for the greed, intellectual dishonesty, and lack of courage of those running the lending program, this would have happened a long time ago.

If you agree, please sign and share this petition.

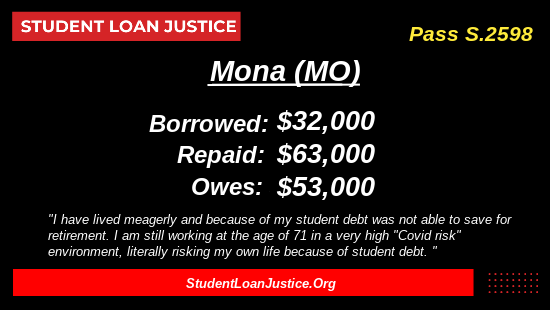

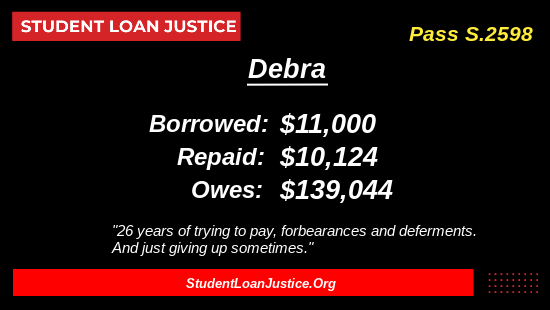

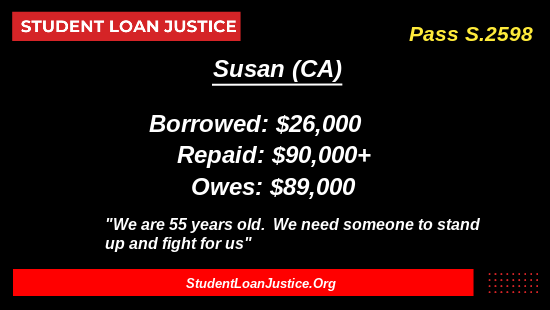

A Few Examples of Seniors with Student Debt: