“New Bankruptcy Process” is a Dangerous Joke on Student Loan Borrowers.

Undue Hardship remains, is only transferred from open court to the bowels of the Administrative State.

On November 17th, 2022, the Departments of Justice and Education unveiled their long-awaited plan to stop opposing student loan borrowers in bankruptcy court. Unfortunately, the plan is a cruel joke on the citizens, and people everywhere should not be mislead.

Unlike all other loans, student loans are uniquely non-dischargeable in bankruptcy because an additional burden of proof, where the borrowers must prove “undue hardship”, where they tried to pay, cannot pay, and will never be able to pay. This has rendered bankruptcy essentially impossible for the vast majority of borrowers, to where the number of discharges in a typical year are in the single digits.

Since President Biden took office, the Department of Education has been teasing that they would stop opposing student loan borrowers in bankruptcy adversarial proceedings, which would have circumvented the undue hardship clause so that student loan borrowers would essentially be treated the same as all other borrowers in bankruptcy court.

What was rolled out, however, is not that. In fact, it is something like the opposite of what was promised.

Instead of simply ending the practice of opposing student loan borrowers in bankruptcy, the Departments of Justice and Education announced that they were introducing a new method for determining undue hardship, where the borrower pleads their claim of undue hardship to the agencies outside of court, rather than in court directly.

The proposal today does not eliminate undue hardship. It keeps undue hardship completely intact. The only difference will be that the borrower pleads their case to unelected, unappointed bureaucrats (or more likely, contractors) for the Department of Education rather than a bankruptcy judge.

Make no mistake, the staffers and contractors for the Department of Education have never had any desire or intentions of cancelling or discharging loans through any of the forgiveness, Income Driven Repayment or any other programs they have administered, and this certainly has not changed.

These are the very same people who in the past have opposed student loan borrowers for outrageous reasons, such as one woman for going to McDonalds on Sundays (an unnecessary expense), or another for having a 14-year-old son who could soon get a job, and earn money to help pay for his mothers student loan debts.

This is a Department of Education whose Secretary had to be threatened with prison time by a federal judge to be compelled to cancel loans.

The undue hardship test is still there, it’s just that the Department of Education (and its contractors, likely) are now effectively the judge of this, instead of an actual judge, for all intents. Also, in order to find out if one might be determined to have an “undue hardship”, one must first both file for bankruptcy, and also pay thousands more to initiate an adversarial proceeding in order to get a “verdict” from the Department of Education (or more likely, its contractors from places like ECMC, which makes its living defeating bankrupt student loan borrowers in court).

While The Departments of Education and Justice are “selling” this change as a bid to be more friendly to student loan borrowers, it is equally if not more likely that they could use this assumed power to be more restrictive. After all, a growing number of judges have been more lenient in recent years in their determinations of undue hardship, and if history is any guide (not to mention financial interest), the Department of Education would like very much to preserve the predatory- and hugely profitable- nature of this lending system.

So trying to discharge student loans in bankruptcy is still a hugely risky proposition, and there is absolutely no good reason to believe that the Department has suddenly changed their culture on this topic. It could even be worse, and if past history is any guide, it’s more likely to be worse than better.

The new bankruptcy process only gives the bankruptcy attorneys a “golden carrot” to wag in front of desperate student loan borrowers, convince them to both file for bankruptcy (which is both shameful and expensive), pay several thousands more to initiate an adversarial proceeding which will, in all likelihood, not be successful. This sets families like this one up for all of the shame of a bankruptcy, with none of the relief. This is immoral and cruel.

People should be wary, and not be fooled by this obvious and shameful trickery.

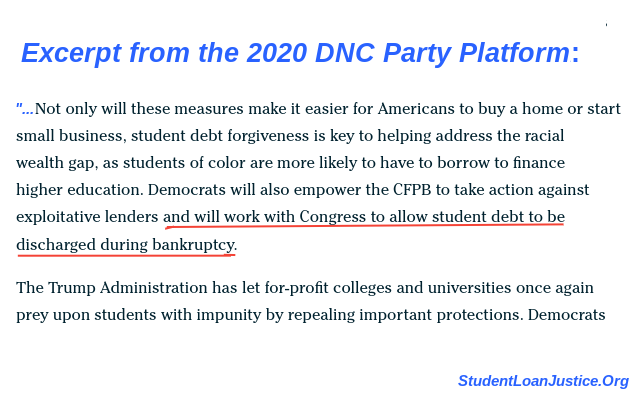

Congress- in particular the Democrats who currently control Congress, have two bills in the House and Senate (S.2598 and HR. 9110), which would return standard bankruptcy rights to federal student loan borrowers with a ten-year waiting period. The Democrats have a longstanding promise to return bankruptcy protections to student loans.

If they want to regain any of the trust they have lost, and will lose with the 42 million distressed student loan borrowers in the country, they will make good on that promise and pass these bills before the year is out.