Biden’s Loan Cancellation Plan is Vague, Tricky, unimpressive.

The Department of Education will find ways to not cancel loans

The Biden Administration announced a federal student loan cancellation action today. The Department of Education said that they will cancel “up to $10,000” in federally held student loans for everyone earning less than $125,000/year, and “Up to $20,000” for people who received the Pell Grant while in college.

As someone who has followed the Department of Education and the federal student loan program intently for 18 years, who was interviewed for the first media article to be written that discussed the possibility of broad student loan cancellation by executive order, and who started the petition in March 2020 calling for this that attracted over 1 million supporters and launched the idea into the mainstream public conversation in March 2020, one would think I’d be overjoyed that finally we have a President committing to cancelling student loans by executive order.

Unfortunately, I am not.

In fact, the announced plan has all the hallmarks of a trick we have seen many times over the years. People should be very wary of- and concerned about- this plan for several reasons.

First: The plan is vague, ambiguous, and suspicious. The “Up to” language used to discuss the cancellation in the announcement could literally mean anything, including nothing (See end note). Also the press release gives no details on the cancellation process, saying only that further details will be made available in the “weeks ahead”.

History has shown that the Department of Education has never had any desires or intentions of cancelling loans. If they can find a way to not cancel loans, they will vigorously exploit it.

For Example: The overwhelming majority (99%) of borrowers who try for the various Income Driven Repayment (IDR) programs are being disqualified . Out of several million people who enrolled in the Income Contingent Repayment Program (ICR) since 1995, only 32 people had made it through as of 2021.

Similarly, it was reported in 2015 that 57% of the those enrolled in Income Based Repayment (IBR) had been disqualified in one year alone for failure to “verify their income”, an annual, onerous exercise required of the borrowers- and one of many ways the Department has to disqualify people out of the program. Given that around 30% of these income verification forms are rejected per year, simple math would predict that the chances of making it through 20 consecutive years shrinks to 0.08%- a vanishingly small percentage.

Similar to the IDR programs, there will be an application, means-testing, and likely other hurdles put in place for Biden’s loan cancellation, including proof, of income, proof that borrowers received the Pell Grant (which could be non-existent for people who went to college many years ago), and any other hurdles that the Department of Education deems to be appropriate.

Given this shameful track record of bad-faithed loan administration, there is no good reason to believe that a large percentage of borrowers will make it through the yet-to-be-announced application process. Frankly, the opposite would appear to be overwhelmingly likely.

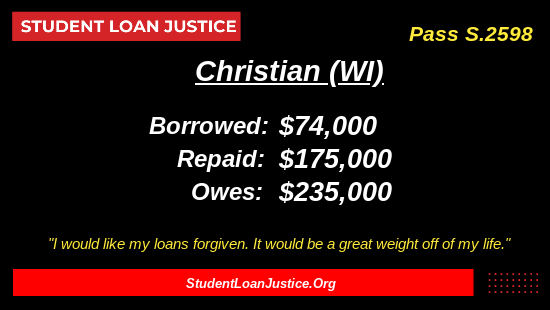

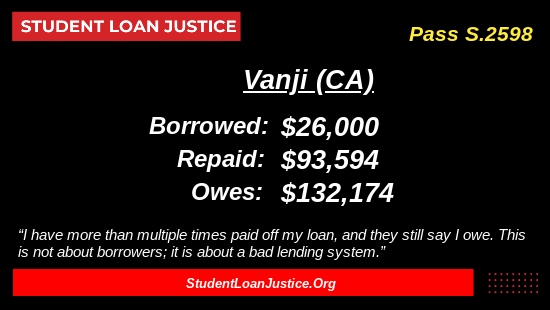

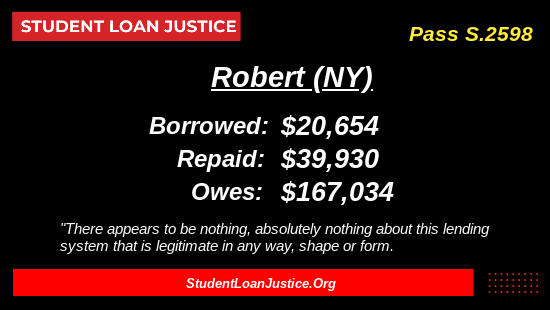

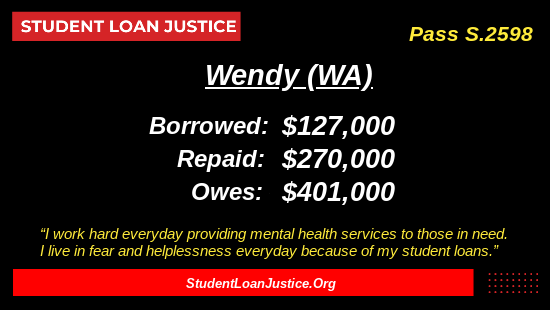

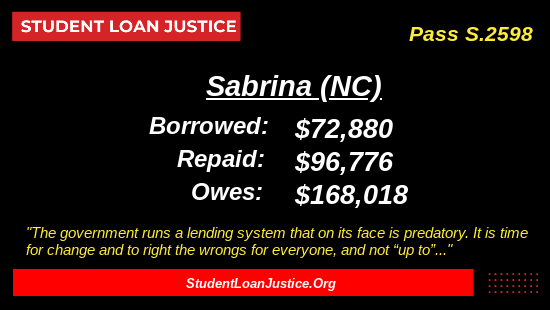

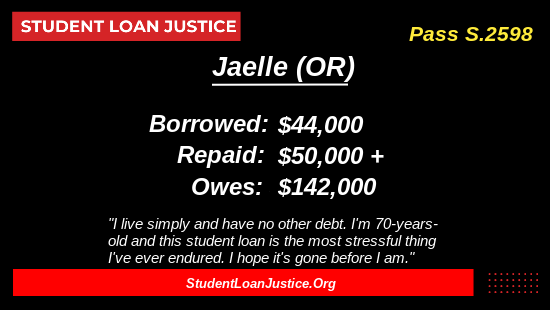

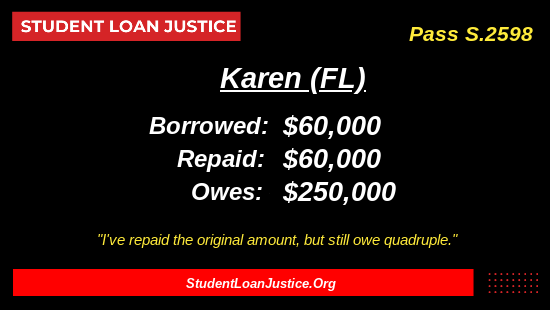

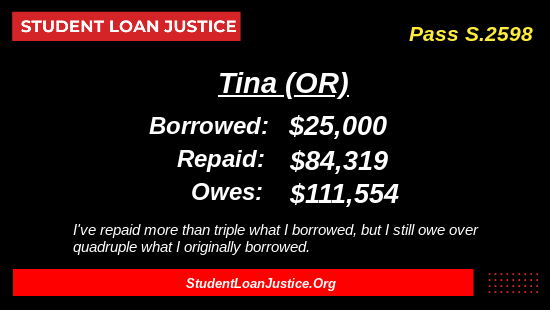

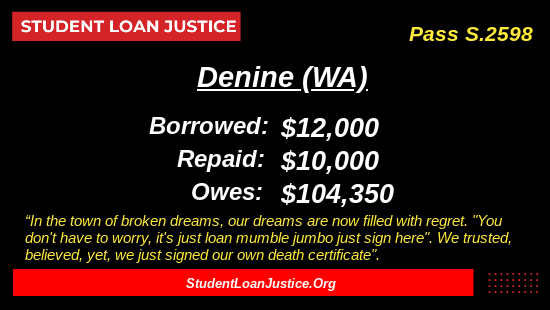

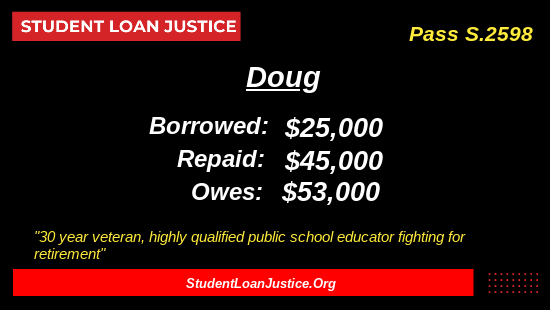

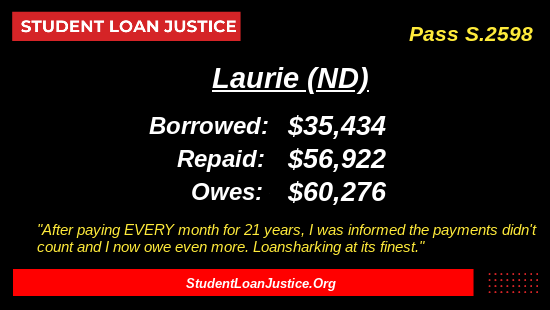

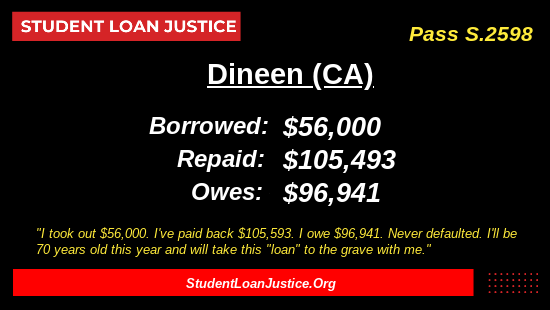

Second, this cancellation plan- even if it performs as advertised- will do little or nothing for the people worst hurt by these loans, namely, older borrowers who been trapped under this debt burden for years or decades, and have seen what began as moderate loan balances grow to outrageous proportions, often despite their having paid back many multiples of what they originally borrowed (such as the example slides below).

Moreover, there apparently will be state tax liability for this cancellation, this will mean a tax burden of approximately $500- $1000 for those living in states with income taxes. This will harm low income people who are already unable to keep up with the cost of living due to inflation. It will also discourage a huge percentage of borrowers from even applying in the first place, particularly high balance borrowers for whom a $10,000 or $20,000 write down may be relatively insignificant. We estimate that around 15% -20% of all borrowers won’t apply based on this tax liability alone. Of course, this is what the Department of Education wants.

This plan also does absolutely nothing for people with the older, legacy, Federal Family Education Loan Program (FFELP) loans, which are largely owned by private banks and investors, and cannot be cancelled administratively.

Also, the Biden announcement makes it clear that this current move is authorized by the HEROES Act, which gives the President the authority to cancel only due to the Covid Emergency, as opposed to the Higher Education Act language, which gives the Secretary of Education broad authority to cancel debt generally. This indicates that they have no intentions of doing similar cancellations in the future. Also, the HEROES Act is just an ill-fitting legal basis, and may well be vulnerable to court challenges. Surely the Department of Education knew this when they made the decision to use this head-scratching legal basis. Frankly, it wreaks of bad faith.

One could be forgiven for wondering aloud if President Biden and the Department of Education actually wanted this plan to be killed by the courts.

This is no time to be celebrating. With the threat of bankruptcy and statutes of limitations still gone from these loans (as they exist for all other loans), borrowers remain vulnerable to all manner of bad-faith loan administration and predatory abuses that have defined this lending system for decades.

This is why we are fighting so hard for S.2598, a bipartisan bill in the Senate that returns limited bankruptcy rights to federal loans, and also requires colleges to reimburse the government for discharges.

Also, the President can order the Department of Education to stop opposing bankruptcy filers in court- something that the Department has already said it was planning to do. This is critical if this failed lending system is to have any hope to regaining its legitimacy.

Please sign this petition if you agree.

Note: subsequent to the publication of this article, the Department of Education published an explainer that stipulated that the “Up to” language means that the cancellation amounts are capped by the debt size. This implies that there will be no other criteria (ie income, etc) that could be used to limit cancellation amounts. We post a screenshot of this here for the record’s sake: