Nearly 1-in-5 U.S. Adults are Distressed Student Loan Borrowers.

They had either stopped paying, or were paying but with increasing loan balances before the pandemic.

This article was updated on 2/16/23 *

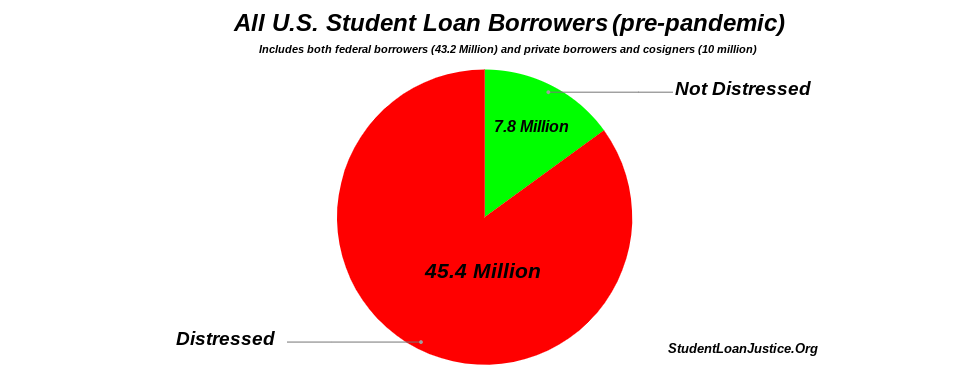

There are about 43.4 million federal student loan borrowers. According to former Federal Student Aid Chief, Wayne Johnson, 85% of these borrowers were either not paying (over 50%), or were paying but with increasing loan balances before the pandemic. So the true size of underwater (i.e. distressed) federal student loan borrowers was about 37 million people before the pandemic. This has likely increased.

Moreover, there are roughly 10 million borrowers (and cosigners) with private student loans, which gives us approximately 53.4 million student loan borrowers in total, or about 21% of all 258 million U.S. adults. Assuming a similar percentage of distressed borrowers for private loans, this give us about 45.4 million distressed student loan borrowers in the country, which is 18%- or nearly 1-in-5- of all U.S. Adults.

This is nearly enough distressed borrowers to elect a President outright, and these people vote.

Critically: This is a bipartisan group of people. Over half of people who attended college identify, politically, as being either republican or independent. Over 40% of borrowers never graduated. “Red” states are being hurt far worse than “blue” states. This problem affects left-leaning and right-leaning voters in roughly equal measures.

Also, the default rate for 2004 borrowers is 40%, but this group was borrowing less than a third of what is being borrowed today. It is not unreasonable to estimate that the default rate among all current borrowers was easily going to exceed 70% even before the pandemic. The sub-prime home mortgage default rate, by comparison, was only 20%

The lending system is in catastrophic failure by all rational metrics.

Both democrats and republicans appear to be doing everything possible to alienate these voters. President Biden’s pre-presidential promise to “eliminate” student debt for people earning less than $125,000/year has withered into a weak, legally embattled plan to cancel $10 — $20k which is insignificant or even insulting for the most distressed borrowers…if it even happens. Republicans are going out of their way to mischaracterize and insult them.

Each party, it would seem, is determined to demoralize or infuriate these 42+ million distressed voters, and defend/perpetuate this failed loan scam on yet another generation of Americans. It is truly baffling.

There are two solutions to this problem. At a minimum, uniform bankruptcy rights must be returned to these loans. Bipartisan legislation comprising S.2598 and HR. 9110 must be passed this session, and President Biden should immediately order the Department of Education to stop opposing student loan borrowers in bankruptcy court.

Ultimately, the loans will have to be broadly- perhaps totally- cancelled. The President should suspend the lending program indefinitely and task Congress with creating a rational, fair system for financing higher education. Federal student loans were clearly a bad idea.

If you are affected by these loans, please sign this petition, and join us in fighting for student loan justice.

*We revised this article slightly to reflect more recent Census data showing that the number of US Adults in the country had grown to 258 million in 2020. This brought the percentage of distressed student loan borrowers down slightly, from about 20% to about 18% of all U.S. adults.